The credit card issuer will keep your deposit if you stop making the minimum payment or can’t pay your credit card balance. The only difference is they require a security deposit that also acts as your credit limit. Secured credit cards work much the same as unsecured credit cards. Get a Secured Credit CardĪs mention earlier, getting a secured credit card is a great way to establish credit. See also: 5 Best Credit Builder Loans for 2022 3. The loan payments are reported to at least one credit bureau, which gives your credit scores a boost.

With credit builder loans, the money sits in a savings account until you’ve completed all your monthly payments. Plus, it’s probably the cheapest and easiest way to boost your credit scores. In fact, credit builder loans do not require a credit check at all. They can help you with the following items:Ĭredit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone. Lexington Law specializes in removing negative items from your credit report. They can help you dispute them and possibly have them removed. If you find any negative items, you may want to hire a credit repair company such as Lexington Law.

#Fico score range free#

It’s a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. Dispute Negative Accounts on Your Credit Report Here are five ways to improve your 673 credit score: 1. However, you still may have some late payments or charges offs reporting.

#Fico score range how to#

See also: 8 Best Auto Loans for Good Credit How to Improve a 673 Credit ScoreĬredit scores in the Good range often reflect a history of paying your bills on time. However, if you want to ensure you qualify for the best interest rates, you will want to continue improving your credit score. Most auto lenders will lend to someone with a 673 score. See also: 10 Best Mortgage Lenders for Good Credit Can I get an auto loan with a 673 credit score? The minimum credit score is around 620 for most conventional lenders, so you should be able to qualify. See Also: 12 Best Personal Loans for Good Credit Can I get a home loan with a credit score of 673? It’s best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” or “Excellent” credit.

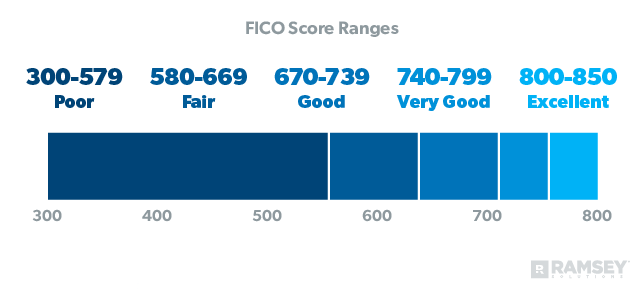

Most lenders will approve you for a personal loan with a 673 credit score. Can you get a personal loan with a credit score of 673? If you are able to get approved for a credit card, remember to always make your monthly payments on time and keep your balance below 30% of your credit limit. However, some credit cards require a higher score. Can you get a credit card with a 673 credit score?Ĭredit card applicants with a credit score in this range will be approved for most credit cards. With a score of 673, your focus should be on raising your credit scores before applying for any loans to make sure you get the best interest rates available. However, you still have room for improvement. Most lenders will lend to borrowers with credit scores in the Good range. : Source: Experian 673 Credit Score Credit Card & Loan Options As you can see below, a 673 credit score is considered Good.

0 kommentar(er)

0 kommentar(er)